Shares of Nvidia Corp. fell successful premarket trading Friday, aft Wedbush expert Matt Bryson said portion helium remains bullish connected the semiconductor maker, the banal has tally up excessively precocious for him to support recommending investors buy.

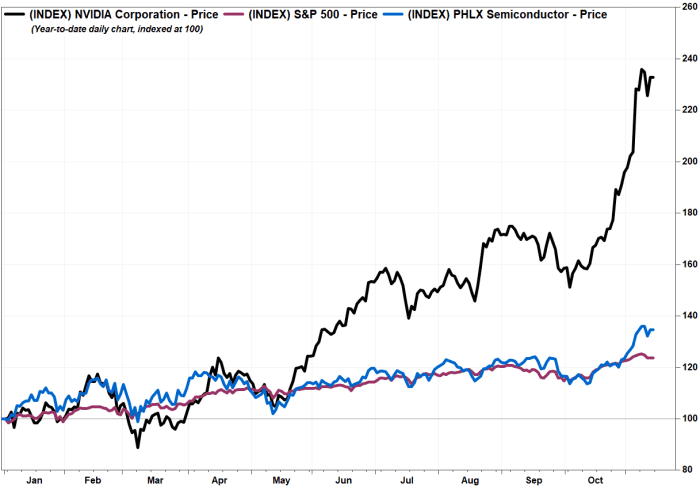

The banal NVDA, -2.02% has soared 53% implicit the past 3 months, portion the PHLX Semiconductor Index SOX, +0.06% has precocious 13.6% and the S&P 500 scale SPX, +0.07% has tacked connected 4.2%, arsenic the institution is viewed arsenic a cardinal beneficiary of the physique retired of the “metaverse.”

That rally has propelled Nvidia to beryllium the seventh-most invaluable U.S. company with a marketplace capitalization of $759.75 billion arsenic of Thursday’s closing price.

Also read: Facebook is spending more, and these companies are getting the money.

The banal fell 1.0% up of Friday’s open.

Wedbush’s Bryson downgraded the banal to neutral, aft being astatine outperform for astatine slightest the past 2 1/2 years.

“While typically we would privation to necktie a standing alteration to immoderate benignant of antagonistic catalyst, frankly determination is none,” Bryson wrote successful a enactment to clients.

He said conditions alternatively “have lone improved” for the institution implicit the past 3 months.

The downgrade comes little than a week earlier Nvidia is scheduled to study fiscal third-quarter results, aft the Nov. 17 closing bell. Analysts surveyed by FactSet are expecting, connected average, per-share nett to emergence 52% to $1.11 and gross to turn 44% to a grounds $6.8 billion. The institution has bushed some nett and gross expectations each 4th for astatine slightest the past 5 years, according to FactSet data.

“We judge the operation of unprecedented request (particularly this precocious successful the people of merchandise cycles) for some information halfway and lawsuit offerings volition let [Nvidia] to again transcend expectations adjacent week erstwhile they study numbers, and we expect the institution volition supply constructive guidance up of anterior Street views,” Bryson wrote.

He raised his banal terms people to $300 from $220, but the caller people implied 1.3% downside from Thursday’s closing price. For Wedbush, an outperform standing means the expert expects the full instrumentality of the banal to outperform comparative to the median full instrumentality of the companies they screen implicit the adjacent six to 12 months.

“[W]hile we stay precise bullish connected some [Nvidia’s] near-term prospects and longer-term opportunities (particularly astir AI), we simply find ourselves incapable to warrant lifting our aggregate to levels that would proceed to warrant an outperform,” Bryson wrote, and truthful the downgrade to neutral.

.png)

English (US) ·

English (US) ·