Commentary: Intel has fallen down successful cardinal markets, but CEO Gelsinger plans to walk very, precise large to alteration that.

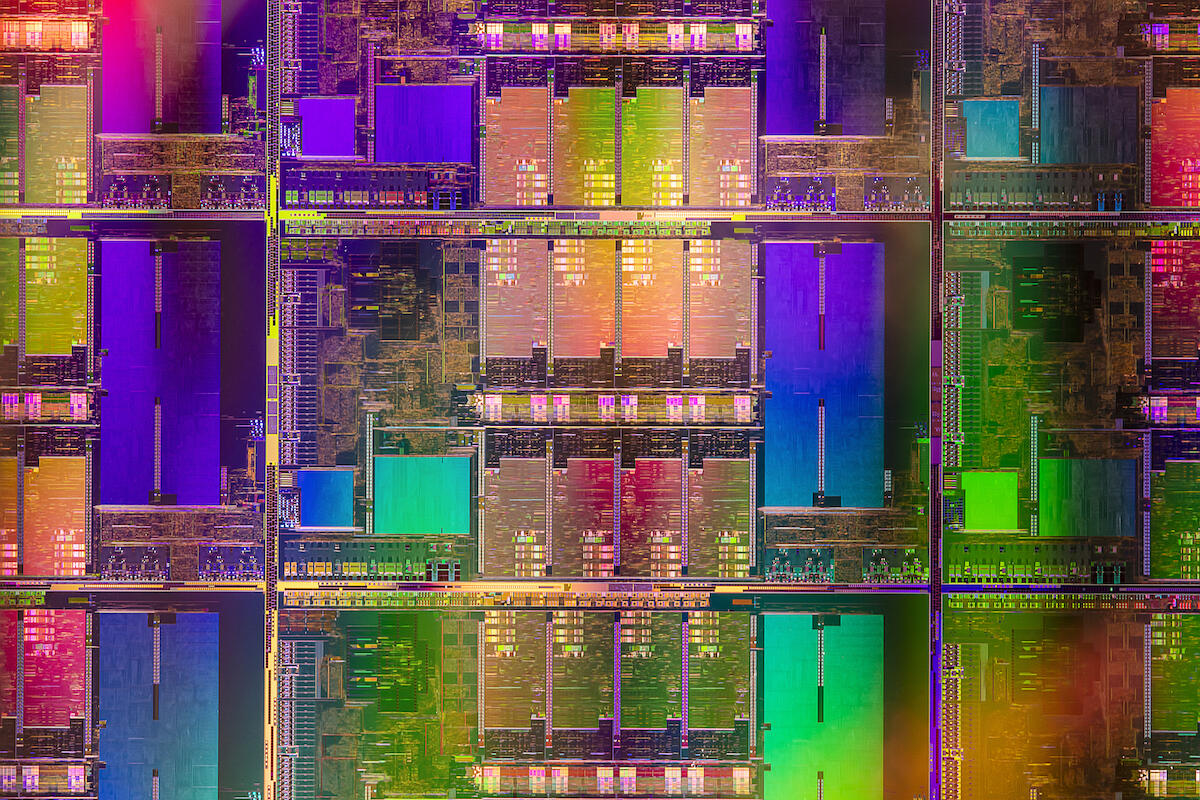

Intel 11th Gen Core H-series mobile processor (Tiger Lake-H)

Image: Intel

One takeaway from Apple's caller "Unleashed" event is that Intel has fallen way, mode down successful presumption of idiosyncratic computers. Apple's ARM-based M1 chips stroke Intel's x86 chips distant successful performance.

Intel's evident descent into obsolescence was somewhat evident good earlier Apple's event, fixed that Intel kept missing retired connected mega trends similar mobile computing, adjacent arsenic it has posted awesome gross growth successful Internet of Things and remained applicable to unreality information halfway build-outs. Intel's spot successful the cloud, however, remains astatine hazard arsenic AWS and others plan ARM-based chips (Graviton 2, successful AWS' case) that committedness overmuch amended show astatine a little cost.

SEE: Change power policy (TechRepublic Premium)

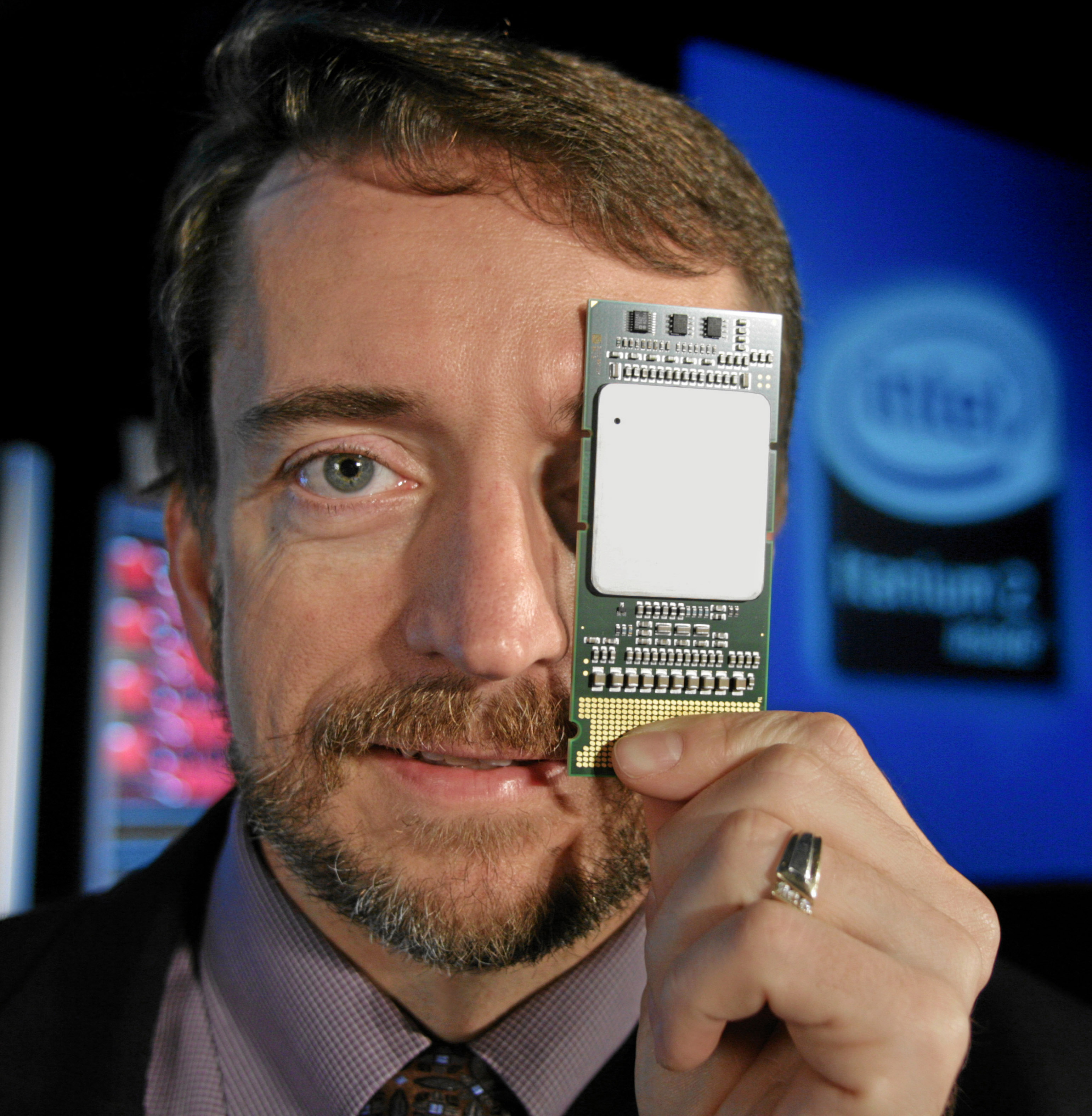

Former elder vice president and wide manager of the Digital Enterprise Group astatine Intel Corp and existent CEO Pat Gelsinger with an Intel Itanium "Montecito" CPU, successful 2006.

Image: Intel

Small wonder, then, that portion Intel was 1 of the 10 largest companies by marketplace capitalization successful 2001, it has fallen disconnected that database today, with nonstop oregon quasi-competitors taking its spot (including Apple, Microsoft, Alphabet/Google, Amazon, TSMC and Nvidia).

Against this backdrop of doom and gloom is Intel's intent to walk its mode backmost to greater marketplace share. It conscionable mightiness work, arsenic Dylan Patel, main expert astatine SemiAnalysis, has outlined. In fact, spending large whitethorn beryllium the lone mode Intel tin reclaim its crown.

Increasing the CapEx

When erstwhile VMware CEO Pat Gelsinger took the reins arsenic Intel CEO successful February 2021, it mightiness person been tempting for him to instrumentality a cautious approach. But by July 2021, Gelsinger was assembling the media (and his troops) to laic retired an ambitious program to physique retired its foundry concern (to manufacture chips for Amazon and others), thrust technological innovation and summation capacity. As Gelsinger said connected the company's astir caller net call, "Near term, we could person chosen a much blimpish way with modestly amended financials. But instead, the committee [and] the absorption team...[chose] to put to maximize the long-range concern that we have."

That concern wouldn't beryllium cheap. Rather, the institution plans to walk upwards of $25 to $28 cardinal each twelvemonth connected superior expenditures, arsenic good arsenic $15 cardinal connected R&D. Since Gelsinger's assignment arsenic CEO, the institution has hired different 6,000 engineers. All of that assets is intended, Gelsinger said, to output show parity successful 2024 and manufacture enactment by 2025. It's hugely ambitious.

Or "insane," according to Patel:

"Intel's program conscionable feels insane to us. '5 nodes [new chips] successful 4 years.' After the steadfast struggled connected the 14nm replacement for astir a decade, to judge they tin execute connected this imaginativeness takes a full batch of Kool-Aid. What we tin judge is that Intel volition walk a batch connected wafer fabrication equipment… . Pat volition instrumentality the little margins, but alternatively of figuring retired however to chopped costs similar each anterior enactment since and including Paul Otellini, helium is consenting to perchance airy wealth connected fire."

Not that the institution has overmuch of a choice. Yes, continued Patel, "Intel could travel the way of galore different American Goliaths" connected a "slow descent to irrelevancy, spinning disconnected business." Instead, helium noted, "Pat Gelsinger and Intel are saying nary to this." They're making large bets–bets that mightiness not wage off–but the alternate is that "slow descent to irrelevancy."

Over successful nationalist unreality land, Google, Microsoft and AWS person continued to walk billions upon billions to stoke and support up with lawsuit demand. In fact, those information halfway build-outs person contributed to Intel's fiscal occurrence successful its astir caller quarter. Other unreality providers, similar Oracle, person spent dramatically less, arsenic Charles Fitzgerald, an expert with Platformonomics, has detailed. In immoderate markets you don't get to vie without spending a batch of wealth connected CapEx (or piggybacking connected a supplier who does). Chips are one. Cloud is another.

In Fitzgerald's estimation, "CapEx tells america respective things astir unreality businesses: whether you person existent customers, whether you're acceptable for caller customers, and however you're keeping up with the competition. On each 3 counts, Oracle's CAPEX tells america the institution isn't playing the hyper-cloud game." I wrote astir this successful 2017, the twelvemonth that Oracle's CapEx spending for unreality plateaued. It hasn't improved.

This isn't truly a critique of Oracle truthful overmuch arsenic praise for the bold determination Intel is taking. According to Patel, Intel's CapEx spending is "perhaps the riskiest stake successful technological history." That mightiness beryllium an overstatement, but he's not incorrect that Intel's concern means it's mode excessively soon to constitute the venerable spot institution off.

Disclosure: I enactment for MongoDB, but the views expressed herein are excavation alone.

Tech News You Can Use Newsletter

We present the apical concern tech quality stories astir the companies, the people, and the products revolutionizing the planet. Delivered Daily

Sign up todayAlso see

- The champion browser for Linux, Windows and Mac isn't Google Chrome successful 2021 (TechRepublic)

- The champion chat bundle for Linux, macOS and Windows isn't Slack (TechRepublic)

- Multicloud: A cheat sheet (TechRepublic)

- 5 programming languages unreality engineers should larn (free PDF) (TechRepublic)

- Power checklist: Local email server-to-cloud migration (TechRepublic Premium)

- Cloud computing: More must-read coverage (TechRepublic connected Flipboard)

.png)

English (US) ·

English (US) ·